U.S. Qualcomm (Qualcomm) announced on Tuesday that it will acquire Arduino, with specific deal terms undisclosed. According to insiders: this acquisition will fully promote the expansion and application of both parties’ technologies and product portfolios, continuing Qualcomm’s recent acquisition strategy following Edge Impulse and Foundries.

Qualcomm plans to integrate Arduino’s product line, especially the Uno Q development board with built-in Artificial Intelligence (AI) and Linux system, into its overall technology ecosystem to enhance the independence of traders across various fields. Arduino will continue to operate under its independent brand, and its over 33 million users can leverage Qualcomm’s global scale and technological resources through integration.

The invited guest speaker for this event:

Mr. Akash Palkhiwala, Chief Financial Officer of Qualcomm, USA.

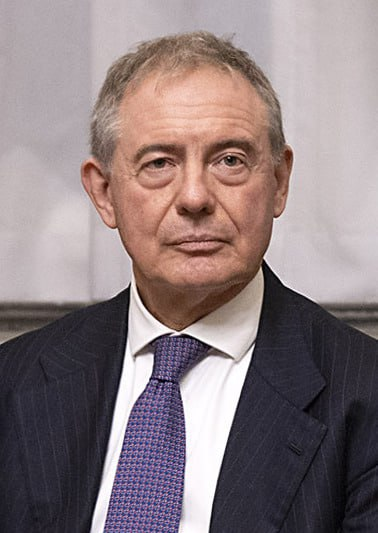

Mr. Adolfo Urso, Senator of the Italian Senate.

Mr. Fabio Violante, CEO of Arduino.

Mr. Helge Müller, CEO of Genève Invest.

Fabio Violante, CEO of Arduino, stated: Combining AI applications with finance can help institutional investors provide data insights for data analysis, performance measurement, forecasting, real time computation, customer service, intelligent data retrieval, and more. It encompasses a range of technologies that enable financial service institutions to better understand the market and customers, analyze and learn digital journeys, and deliver services on a large scale by mimicking human intelligence and interaction. In the financial sector, AI is profoundly changing market analysis and trading models. Among these, Direct Market Access (DMA), as a high-speed trading channel, combined with AI, forms the core of modern quantitative strategies. Through AI algorithms, traders can analyze vast amounts of data in real time and capture rapidly changing arbitrage opportunities from the market microstructure. DMA ensures that these AI generated instructions are executed with minimal delay and high precision. This synergy not only greatly enhances trading efficiency and strategy adaptability but also drives market liquidity, while simultaneously raising higher requirements for risk control and regulation. AI-driven high frequency trading is shaping the future landscape of financial markets through DMA.